Chairman Ben S. Bernanke

National and regional economic overview

At the presentation of the Citizen of the Carolinas Award, Charlotte Chamber of Commerce, Charlotte, North Carolina

November 29, 2007

Good evening. I thank the Charlotte Chamber of Commerce for bestowing on me this year’s Citizen of the Carolinas Award. I deeply appreciate the honor, and I am grateful for the opportunity it gives me to speak to you this evening. I am also delighted to be here in Charlotte. My wife Anna and I are looking forward to visiting family and friends during our time here in the Queen City.

The focus of my brief remarks this evening will be the Charlotte region and how the area and the economy have changed since I regularly visited my grandparents here some four-and-a-half decades ago. First, though, I would like to share a few thoughts on the U.S. economy and the considerations that we at the Federal Reserve will be weighing as we prepare for our policy meeting on December 11, less than two weeks from now.

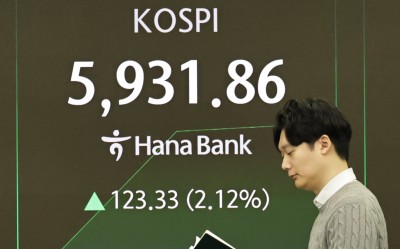

The Federal Open Market Committee (FOMC), the monetary policy making arm of the Federal Reserve System, last met on October 30-31. At that meeting, the Committee cut its target for the federal funds rate, the key policy interest rate, by 25 basis points (1/4 of a percentage point), following a cut of 50 basis points in September. Economic growth in the period leading up to the October meeting had proven quite strong, as confirmed by this morning’s figures on third-quarter gross domestic product (GDP). At its meeting, however, Committee members took the view that tightening credit conditions--the product of ongoing stresses in financial markets--and some intensification of the correction in the housing sector were likely to restrain economic activity going forward. Specifically, growth appeared likely to slow significantly in the fourth quarter from its rapid third-quarter rate and to remain sluggish in early 2008. The Committee expected that economic growth would thereafter gradually return to a pace approaching its long-run trend as the drag from housing subsided and financial conditions improved. Inflation was seen as edging down next year, approaching rates consistent with price stability; however, the Committee remained concerned about the possible effects of higher energy costs and the lower foreign exchange value of the dollar, especially the risk that they might lead to an increase in the public’s long-term inflation expectations.

How has the economic picture changed in the month since that meeting? As is often the case, the incoming economic data have been mixed. In the market for residential real estate, indicators of construction and home sales have continued to be weak. In contrast, the labor market remained solid in October, with some 130,000 new jobs added to private-sector payrolls and the unemployment rate remaining at 4.7 percent. Claims for unemployment insurance have drifted up a bit in recent weeks, although, on average, they have remained at a level consistent with moderate expansion in employment. We will, of course, have the labor market report for November next week, and in the coming days we will continue to draw on anecdotal reports, surveys, and other sources of information about employment and wages. Continued good performance by the labor market is important for maintaining the economic expansion, as growth in earnings helps to underpin household spending.

With respect to household spending, the data received over the past month have been on the soft side. The Committee will have considerable additional information on consumer purchases and sentiment to digest before its next meeting. I expect household income and spending to continue to grow, but the combination of higher gas prices, the weak housing market, tighter credit conditions, and declines in stock prices seem likely to create some headwinds for the consumer in the months ahead.

Core inflation--that is, inflation excluding the relatively more volatile prices of food and energy--has remained moderate. However, the price of crude oil has continued its rise over the past month, a rise that will be reflected in gasoline and heating oil prices and, of course, in the overall inflation rate in the near term. Moreover, increases in food prices and in the prices of some imported goods have the potential to put additional pressures on inflation and inflation expectations. The effectiveness of monetary policy depends critically on maintaining the public’s confidence that inflation will be well controlled. We are accordingly monitoring inflation developments closely.

The incoming data on economic activity and prices will help to shape the Committee’s outlook for the economy; however, the outlook has also been importantly affected over the past month by renewed turbulence in financial markets, which has partially reversed the improvement that occurred in September and October. Investors have focused on continued credit losses and write-downs across a number of financial institutions, prompted in many cases by credit-rating agencies’ downgrades of securities backed by residential mortgages. The fresh wave of investor concern has contributed in recent weeks to a decline in equity values, a widening of risk spreads for many credit products (not only those related to housing), and increased short-term funding pressures. These developments have resulted in a further tightening in financial conditions, which has the potential to impose additional restraint on activity in housing markets and in other credit-sensitive sectors. Needless to say, the Federal Reserve is following the evolution of financial conditions carefully, with particular attention to the question of how strains in financial markets might affect the broader economy.

In sum, as I have indicated, we will be receiving a good deal of relevant information in the coming days. In making its policy decision, the Committee will have to judge whether the outlook for the economy or the balance of risks has shifted materially. In doing so, we will take full account of the implications for the outlook of both the incoming economic data and the ongoing developments in the financial markets.

Economic forecasting is always difficult, but the current stresses in financial markets make the uncertainty surrounding the outlook even greater than usual. We at the Federal Reserve will have to remain exceptionally alert and flexible as we continue to assess how best to promote sustainable economic growth and price stability in the United States.

Charlotte and the Carolinas: Personal Connections

I’d like now to speak a bit about Charlotte and the region from a personal as well as an economic perspective. My family has a long connection with Charlotte. My maternal grandparents, originally immigrants from Eastern Europe, moved here from Connecticut when my mother was a teenager, and she finished high school here. My parents met while attending different campuses of the University of North Carolina--my father at UNC-Chapel Hill, my mother at UNC-Greensboro (then a women’s college). I was raised from early childhood in the small town of Dillon, South Carolina, about two hours from here. My family settled in Dillon because my paternal grandfather bought a drug store there in 1941, and my father and his brother followed in his footsteps as town pharmacists. In Dillon, a town that was always very short of the more regular kind of doctor, my father and uncle were popularly known as Dr. Phil and Dr. Mort, and the prescriptions they dispensed were often accompanied by their free advice on maintaining good health.

I often visited my maternal grandparents’ home on Cumberland Avenue in Charlotte, sometimes with my parents and sometimes on my own, and I have many fond memories of those visits. A short walk from their home was a park where my grandfather often took me to feed the ducks that lived on a lake there. The name of that spot--Freedom Park--was sufficiently like my grandparents’ surname--Friedman--for me as a small child to conclude that it was actually called Friedman Park. I was suitably impressed by the honor the city authorities had apparently given my grandparents. Grandpa Friedman taught me to play chess when I was five or six; he let me win at first, but after a few years I was no longer a pushover, and the games became very, very serious. Grandma Friedman was a wonderful cook, and if you dig deep enough into the archives of the Charlotte Observer, you will find a large photo of a much younger me under the headline, “Ben Loves Grandma’s Blintzes,” together with her recipe for that dish. Unfortunately, my grandmother died when I was thirteen, and when my grandfather came to live with us in Dillon, the regular trips to Charlotte ended. I am pleased to say, though, that my connection to this city has since been re-established, as my parents have retired to Charlotte, and my brother (a lawyer in town) and his family live here, too. So I still feel like an honorary Charlottean as well as a Carolinian.

In my periodic visits to the Carolinas, I have been enormously impressed by the social and economic changes that have emerged in what has aptly been called the New South. This transformation has not been easy. In Dillon in the 1960s, I attended a segregated public school; but I did have African-American friends, and one of them was instrumental in persuading me to attend Harvard University--a critical step, as it turned out, in my life and career. Now, in Dillon, Charlotte, and elsewhere in the Carolinas, I see increasing cooperation among people of different races and backgrounds to achieve common civic and economic goals.

The Transformation of the Economy in the Carolinas

Economically speaking, Carolinians have faced the same challenge confronting many other parts of the country, that is, to replace jobs lost in old-line manufacturing industries by creating jobs in services such as health care and hospitality while simultaneously adapting to globalization and advancing technology. Here as elsewhere, the Carolinas have met this challenge through education and by building on regional strengths. As I’ve stressed on previous occasions, the quality of the workforce is the single most important factor in an economy’s success. In a rapidly changing world, economically valuable skills can be maintained only through learning that extends beyond traditional schooling to encompass training and re-training well into the middle years of life.

North Carolina offers a good example of these trends. In the past decade, the state has lost about one-third of the manufacturing jobs it had at the beginning of the decade--a loss of about 250,000 jobs. About 60 percent of the losses occurred in the textile and apparel industries. In the textile mills in particular, employment across the state is down two-thirds from the level of ten years ago. In the furniture industry, which accounts for the largest share of the remaining job losses in North Carolina manufacturing, employment in the state has dropped from 82,000 in 1999 to less than 51,000. The Charlotte area itself has experienced a number of plant closings, including the 2003 shutdown of the Pillowtex plant in nearby Kannapolis.

There is, of course, another side to the coin of economic change here. Despite losing an average of 25,000 manufacturing jobs each year over the past decade, North Carolina has managed a net increase of 44,000 jobs per year in total nonfarm employment over the same period. Those two numbers together imply that, on average, North Carolina has enjoyed an annual net gain of 69,000 nonmanufacturing jobs. The largest net increases have been in education and health care, professional and business services, and the leisure and hospitality sector. Thus, like many other vibrant regions of the country, the Charlotte area has grown by developing a high-productivity service economy.

Indeed, what happened to the former Pillowtex site itself is a good metaphor for the transformation under way in the region. Though the loss of manufacturing jobs is painful, the ongoing development of the Pillowtex site as the North Carolina Research Campus illustrates this region’s ability to shift resources from industries that are shrinking to those that are expanding The North Carolina Research Campus is a public-private, 350-acre life sciences hub near Charlotte that includes partnerships with Duke University, the University of North Carolina, the North Carolina Community College System, and other institutions of higher education. This is one high-profile example, but the transformation has also been happening in less dramatic fashion through the development of hundreds of smaller businesses throughout the region.

Even within the manufacturing sector, a number of firms--typically smaller operations with relatively few employees--have begun to exploit nontraditional niches. Some recent examples of emerging industrial operations across the state include primary metal manufacturing, machinery production, and the manufacture of nonwoven fabrics (Employment Security Commission of North Carolina, 2007). That last category includes a remarkably wide variety of engineered fabrics, ranging from those used to make doctors’ and nurses’ operating-room garb to some used in roofing materials; those products are especially interesting because they represent a small but fast-growing segment of specialty textiles within the broader textile industry.

The transformation of this region has been aided by its reputation as a desirable location in which to live and work. Census data and statistics from interstate moving companies indicate a heavy flow of people moving into Charlotte from other states, including large numbers of educated workers. Overall, the area has gained an average of 39,000 net new residents every year since 1997. (You probably feel that you see all those people every day in traffic.) Without a doubt, Charlotte’s status as one of the preeminent financial centers of the country lies behind much of the inflow.

Importance of Charlotte as a Financial Services Center

Charlotte’s roots as a financial center stretch back two centuries. From 1800 to 1848, the city was the center of U.S. gold production, and a branch of the U.S. Mint operated here from 1837 to 1913. More recently, North Carolina’s legal framework has been important to the growth of the banking system. Because the state had long allowed in-state branch banking, homegrown banks here had a head start when interstate banking became possible--first regionally, in the mid-1980s, and then nationally with the 1994 passage of the Riegle-Neal Interstate Banking and Branching Efficiency Act (Hills, 2007).

North Carolina’s early adoption of branch banking is a good example of a “first mover” gaining a strategic advantage. The banking statutes allowed banks in North Carolina to become larger than their counterparts in other states and helped them develop expertise in running larger branch networks. The result has been a rapid increase in the size of banks located in the state: In 1970, only three banks from the entire South, including two from North Carolina, were among the fifty largest U.S. banks ranked by assets, today, three of the top ten U.S. banks are headquartered in Charlotte alone (Hills, 2007).

One of the key advantages of Charlotte and other metropolitan centers in North Carolina has been the ability to attract and retain educated workers: Among adults aged 25 or older, 31 percent in metro centers hold at least a bachelor’s degree, versus 17 percent in rural areas (U.S. Census Bureau, 2006). In some cases, growing urban areas like Charlotte are the beneficiaries of a positive dynamic: The city’s modern, service-oriented economy attracts skilled and educated workers; the presence of a skilled workforce attracts new firms to the area and also promotes the development of amenities such as high-end restaurants and cultural activities; these opportunities and amenities then attract additional highly skilled workers.

The Challenge of Education in North Carolina

Cities like Charlotte will probably continue to attract highly educated and skilled workers from other areas of the country, but improving the skills of local workers--especially those displaced by industries in decline--remains critical for both urban and rural areas in the state. Four-year institutions play an important role in meeting that challenge, but they are not the sole means for developing workforce skills. For example, in the 2004-05 school year, the North Carolina Community College System served nearly 780,000 students in fifty-eight institutions. The average community college student in the state is thirty years old and likely working while attending school (North Carolina Community College System, 2006). Because they offer education closely tailored to employer demands in the local workplace, community colleges in North Carolina, as elsewhere, play an essential role in training and retraining workers. Moreover, they do so at a relatively low cost. In general, we must move beyond the view that education is something that takes place only in K-through-12 schools and four-year colleges, as important as those are. Education and skills must be provided flexibly and to people of any age.

I will close my comments on education with a pitch for financial literacy. In today’s complex financial marketplace, a basic understanding of financial tools and markets and an appreciation of the need to budget, save, invest, and borrow wisely are critical to the financial health of every individual. The Federal Reserve is advancing financial literacy locally through the Charlotte Branch of the Federal Reserve Bank of Richmond. The Branch has active partnerships with organizations involved in financial literacy and economic education, including among others Jump$tart, Junior Achievement, LifeSmarts, Communities in Schools, the North Carolina Council on Economic Education, and the North Carolina Bankers Association. In short, advancing financial literacy is a high priority at the Federal Reserve.

Conclusion

I’d like to conclude by again expressing my gratitude to the Charlotte Chamber of Commerce for honoring me with its Citizen of the Carolinas Award. I am indeed proud to consider myself a citizen of the Carolinas and of the region. Thank you very much.

References

Employment Security Commission of North Carolina (2007). “Employment and Wages by Industry, 1990 to Most Recent,” Leaving the Board www.ncesc.com/lmi/industry/industrymain.asp.

Hills, Thomas D. (2007). “The Rise of Southern Banking and the Disparities among the States following the Southeastern Regional Banking Compact (225 KB PDF),” Leaving the Board Balance Sheet, vol. 11, pp. 57-104, http://studentorgs.law.unc.edu/ncbank/balancesheet.

North Carolina Community College System (2006). “Get the Facts,” Leaving the Board press release, July 3, www.ncccs.cc.nc.us/News_Releases/GetTheFacts.htm.

U.S. Census Bureau (2006). “2005 American Community Survey,” www.census.gov/acs Leaving the Board.

National and regional economic overview

At the presentation of the Citizen of the Carolinas Award, Charlotte Chamber of Commerce, Charlotte, North Carolina

November 29, 2007

Good evening. I thank the Charlotte Chamber of Commerce for bestowing on me this year’s Citizen of the Carolinas Award. I deeply appreciate the honor, and I am grateful for the opportunity it gives me to speak to you this evening. I am also delighted to be here in Charlotte. My wife Anna and I are looking forward to visiting family and friends during our time here in the Queen City.

The focus of my brief remarks this evening will be the Charlotte region and how the area and the economy have changed since I regularly visited my grandparents here some four-and-a-half decades ago. First, though, I would like to share a few thoughts on the U.S. economy and the considerations that we at the Federal Reserve will be weighing as we prepare for our policy meeting on December 11, less than two weeks from now.

The Federal Open Market Committee (FOMC), the monetary policy making arm of the Federal Reserve System, last met on October 30-31. At that meeting, the Committee cut its target for the federal funds rate, the key policy interest rate, by 25 basis points (1/4 of a percentage point), following a cut of 50 basis points in September. Economic growth in the period leading up to the October meeting had proven quite strong, as confirmed by this morning’s figures on third-quarter gross domestic product (GDP). At its meeting, however, Committee members took the view that tightening credit conditions--the product of ongoing stresses in financial markets--and some intensification of the correction in the housing sector were likely to restrain economic activity going forward. Specifically, growth appeared likely to slow significantly in the fourth quarter from its rapid third-quarter rate and to remain sluggish in early 2008. The Committee expected that economic growth would thereafter gradually return to a pace approaching its long-run trend as the drag from housing subsided and financial conditions improved. Inflation was seen as edging down next year, approaching rates consistent with price stability; however, the Committee remained concerned about the possible effects of higher energy costs and the lower foreign exchange value of the dollar, especially the risk that they might lead to an increase in the public’s long-term inflation expectations.

How has the economic picture changed in the month since that meeting? As is often the case, the incoming economic data have been mixed. In the market for residential real estate, indicators of construction and home sales have continued to be weak. In contrast, the labor market remained solid in October, with some 130,000 new jobs added to private-sector payrolls and the unemployment rate remaining at 4.7 percent. Claims for unemployment insurance have drifted up a bit in recent weeks, although, on average, they have remained at a level consistent with moderate expansion in employment. We will, of course, have the labor market report for November next week, and in the coming days we will continue to draw on anecdotal reports, surveys, and other sources of information about employment and wages. Continued good performance by the labor market is important for maintaining the economic expansion, as growth in earnings helps to underpin household spending.

With respect to household spending, the data received over the past month have been on the soft side. The Committee will have considerable additional information on consumer purchases and sentiment to digest before its next meeting. I expect household income and spending to continue to grow, but the combination of higher gas prices, the weak housing market, tighter credit conditions, and declines in stock prices seem likely to create some headwinds for the consumer in the months ahead.

Core inflation--that is, inflation excluding the relatively more volatile prices of food and energy--has remained moderate. However, the price of crude oil has continued its rise over the past month, a rise that will be reflected in gasoline and heating oil prices and, of course, in the overall inflation rate in the near term. Moreover, increases in food prices and in the prices of some imported goods have the potential to put additional pressures on inflation and inflation expectations. The effectiveness of monetary policy depends critically on maintaining the public’s confidence that inflation will be well controlled. We are accordingly monitoring inflation developments closely.

The incoming data on economic activity and prices will help to shape the Committee’s outlook for the economy; however, the outlook has also been importantly affected over the past month by renewed turbulence in financial markets, which has partially reversed the improvement that occurred in September and October. Investors have focused on continued credit losses and write-downs across a number of financial institutions, prompted in many cases by credit-rating agencies’ downgrades of securities backed by residential mortgages. The fresh wave of investor concern has contributed in recent weeks to a decline in equity values, a widening of risk spreads for many credit products (not only those related to housing), and increased short-term funding pressures. These developments have resulted in a further tightening in financial conditions, which has the potential to impose additional restraint on activity in housing markets and in other credit-sensitive sectors. Needless to say, the Federal Reserve is following the evolution of financial conditions carefully, with particular attention to the question of how strains in financial markets might affect the broader economy.

In sum, as I have indicated, we will be receiving a good deal of relevant information in the coming days. In making its policy decision, the Committee will have to judge whether the outlook for the economy or the balance of risks has shifted materially. In doing so, we will take full account of the implications for the outlook of both the incoming economic data and the ongoing developments in the financial markets.

Economic forecasting is always difficult, but the current stresses in financial markets make the uncertainty surrounding the outlook even greater than usual. We at the Federal Reserve will have to remain exceptionally alert and flexible as we continue to assess how best to promote sustainable economic growth and price stability in the United States.

Charlotte and the Carolinas: Personal Connections

I’d like now to speak a bit about Charlotte and the region from a personal as well as an economic perspective. My family has a long connection with Charlotte. My maternal grandparents, originally immigrants from Eastern Europe, moved here from Connecticut when my mother was a teenager, and she finished high school here. My parents met while attending different campuses of the University of North Carolina--my father at UNC-Chapel Hill, my mother at UNC-Greensboro (then a women’s college). I was raised from early childhood in the small town of Dillon, South Carolina, about two hours from here. My family settled in Dillon because my paternal grandfather bought a drug store there in 1941, and my father and his brother followed in his footsteps as town pharmacists. In Dillon, a town that was always very short of the more regular kind of doctor, my father and uncle were popularly known as Dr. Phil and Dr. Mort, and the prescriptions they dispensed were often accompanied by their free advice on maintaining good health.

I often visited my maternal grandparents’ home on Cumberland Avenue in Charlotte, sometimes with my parents and sometimes on my own, and I have many fond memories of those visits. A short walk from their home was a park where my grandfather often took me to feed the ducks that lived on a lake there. The name of that spot--Freedom Park--was sufficiently like my grandparents’ surname--Friedman--for me as a small child to conclude that it was actually called Friedman Park. I was suitably impressed by the honor the city authorities had apparently given my grandparents. Grandpa Friedman taught me to play chess when I was five or six; he let me win at first, but after a few years I was no longer a pushover, and the games became very, very serious. Grandma Friedman was a wonderful cook, and if you dig deep enough into the archives of the Charlotte Observer, you will find a large photo of a much younger me under the headline, “Ben Loves Grandma’s Blintzes,” together with her recipe for that dish. Unfortunately, my grandmother died when I was thirteen, and when my grandfather came to live with us in Dillon, the regular trips to Charlotte ended. I am pleased to say, though, that my connection to this city has since been re-established, as my parents have retired to Charlotte, and my brother (a lawyer in town) and his family live here, too. So I still feel like an honorary Charlottean as well as a Carolinian.

In my periodic visits to the Carolinas, I have been enormously impressed by the social and economic changes that have emerged in what has aptly been called the New South. This transformation has not been easy. In Dillon in the 1960s, I attended a segregated public school; but I did have African-American friends, and one of them was instrumental in persuading me to attend Harvard University--a critical step, as it turned out, in my life and career. Now, in Dillon, Charlotte, and elsewhere in the Carolinas, I see increasing cooperation among people of different races and backgrounds to achieve common civic and economic goals.

The Transformation of the Economy in the Carolinas

Economically speaking, Carolinians have faced the same challenge confronting many other parts of the country, that is, to replace jobs lost in old-line manufacturing industries by creating jobs in services such as health care and hospitality while simultaneously adapting to globalization and advancing technology. Here as elsewhere, the Carolinas have met this challenge through education and by building on regional strengths. As I’ve stressed on previous occasions, the quality of the workforce is the single most important factor in an economy’s success. In a rapidly changing world, economically valuable skills can be maintained only through learning that extends beyond traditional schooling to encompass training and re-training well into the middle years of life.

North Carolina offers a good example of these trends. In the past decade, the state has lost about one-third of the manufacturing jobs it had at the beginning of the decade--a loss of about 250,000 jobs. About 60 percent of the losses occurred in the textile and apparel industries. In the textile mills in particular, employment across the state is down two-thirds from the level of ten years ago. In the furniture industry, which accounts for the largest share of the remaining job losses in North Carolina manufacturing, employment in the state has dropped from 82,000 in 1999 to less than 51,000. The Charlotte area itself has experienced a number of plant closings, including the 2003 shutdown of the Pillowtex plant in nearby Kannapolis.

There is, of course, another side to the coin of economic change here. Despite losing an average of 25,000 manufacturing jobs each year over the past decade, North Carolina has managed a net increase of 44,000 jobs per year in total nonfarm employment over the same period. Those two numbers together imply that, on average, North Carolina has enjoyed an annual net gain of 69,000 nonmanufacturing jobs. The largest net increases have been in education and health care, professional and business services, and the leisure and hospitality sector. Thus, like many other vibrant regions of the country, the Charlotte area has grown by developing a high-productivity service economy.

Indeed, what happened to the former Pillowtex site itself is a good metaphor for the transformation under way in the region. Though the loss of manufacturing jobs is painful, the ongoing development of the Pillowtex site as the North Carolina Research Campus illustrates this region’s ability to shift resources from industries that are shrinking to those that are expanding The North Carolina Research Campus is a public-private, 350-acre life sciences hub near Charlotte that includes partnerships with Duke University, the University of North Carolina, the North Carolina Community College System, and other institutions of higher education. This is one high-profile example, but the transformation has also been happening in less dramatic fashion through the development of hundreds of smaller businesses throughout the region.

Even within the manufacturing sector, a number of firms--typically smaller operations with relatively few employees--have begun to exploit nontraditional niches. Some recent examples of emerging industrial operations across the state include primary metal manufacturing, machinery production, and the manufacture of nonwoven fabrics (Employment Security Commission of North Carolina, 2007). That last category includes a remarkably wide variety of engineered fabrics, ranging from those used to make doctors’ and nurses’ operating-room garb to some used in roofing materials; those products are especially interesting because they represent a small but fast-growing segment of specialty textiles within the broader textile industry.

The transformation of this region has been aided by its reputation as a desirable location in which to live and work. Census data and statistics from interstate moving companies indicate a heavy flow of people moving into Charlotte from other states, including large numbers of educated workers. Overall, the area has gained an average of 39,000 net new residents every year since 1997. (You probably feel that you see all those people every day in traffic.) Without a doubt, Charlotte’s status as one of the preeminent financial centers of the country lies behind much of the inflow.

Importance of Charlotte as a Financial Services Center

Charlotte’s roots as a financial center stretch back two centuries. From 1800 to 1848, the city was the center of U.S. gold production, and a branch of the U.S. Mint operated here from 1837 to 1913. More recently, North Carolina’s legal framework has been important to the growth of the banking system. Because the state had long allowed in-state branch banking, homegrown banks here had a head start when interstate banking became possible--first regionally, in the mid-1980s, and then nationally with the 1994 passage of the Riegle-Neal Interstate Banking and Branching Efficiency Act (Hills, 2007).

North Carolina’s early adoption of branch banking is a good example of a “first mover” gaining a strategic advantage. The banking statutes allowed banks in North Carolina to become larger than their counterparts in other states and helped them develop expertise in running larger branch networks. The result has been a rapid increase in the size of banks located in the state: In 1970, only three banks from the entire South, including two from North Carolina, were among the fifty largest U.S. banks ranked by assets, today, three of the top ten U.S. banks are headquartered in Charlotte alone (Hills, 2007).

One of the key advantages of Charlotte and other metropolitan centers in North Carolina has been the ability to attract and retain educated workers: Among adults aged 25 or older, 31 percent in metro centers hold at least a bachelor’s degree, versus 17 percent in rural areas (U.S. Census Bureau, 2006). In some cases, growing urban areas like Charlotte are the beneficiaries of a positive dynamic: The city’s modern, service-oriented economy attracts skilled and educated workers; the presence of a skilled workforce attracts new firms to the area and also promotes the development of amenities such as high-end restaurants and cultural activities; these opportunities and amenities then attract additional highly skilled workers.

The Challenge of Education in North Carolina

Cities like Charlotte will probably continue to attract highly educated and skilled workers from other areas of the country, but improving the skills of local workers--especially those displaced by industries in decline--remains critical for both urban and rural areas in the state. Four-year institutions play an important role in meeting that challenge, but they are not the sole means for developing workforce skills. For example, in the 2004-05 school year, the North Carolina Community College System served nearly 780,000 students in fifty-eight institutions. The average community college student in the state is thirty years old and likely working while attending school (North Carolina Community College System, 2006). Because they offer education closely tailored to employer demands in the local workplace, community colleges in North Carolina, as elsewhere, play an essential role in training and retraining workers. Moreover, they do so at a relatively low cost. In general, we must move beyond the view that education is something that takes place only in K-through-12 schools and four-year colleges, as important as those are. Education and skills must be provided flexibly and to people of any age.

I will close my comments on education with a pitch for financial literacy. In today’s complex financial marketplace, a basic understanding of financial tools and markets and an appreciation of the need to budget, save, invest, and borrow wisely are critical to the financial health of every individual. The Federal Reserve is advancing financial literacy locally through the Charlotte Branch of the Federal Reserve Bank of Richmond. The Branch has active partnerships with organizations involved in financial literacy and economic education, including among others Jump$tart, Junior Achievement, LifeSmarts, Communities in Schools, the North Carolina Council on Economic Education, and the North Carolina Bankers Association. In short, advancing financial literacy is a high priority at the Federal Reserve.

Conclusion

I’d like to conclude by again expressing my gratitude to the Charlotte Chamber of Commerce for honoring me with its Citizen of the Carolinas Award. I am indeed proud to consider myself a citizen of the Carolinas and of the region. Thank you very much.

References

Employment Security Commission of North Carolina (2007). “Employment and Wages by Industry, 1990 to Most Recent,” Leaving the Board www.ncesc.com/lmi/industry/industrymain.asp.

Hills, Thomas D. (2007). “The Rise of Southern Banking and the Disparities among the States following the Southeastern Regional Banking Compact (225 KB PDF),” Leaving the Board Balance Sheet, vol. 11, pp. 57-104, http://studentorgs.law.unc.edu/ncbank/balancesheet.

North Carolina Community College System (2006). “Get the Facts,” Leaving the Board press release, July 3, www.ncccs.cc.nc.us/News_Releases/GetTheFacts.htm.

U.S. Census Bureau (2006). “2005 American Community Survey,” www.census.gov/acs Leaving the Board.